Media

A Look at the Future of Blockchain and Identity Management

December 07, 2019

A couple of hundred years ago, the concept of identity verification would have been alien to the average person. A couple of hundred years from now, identity verification is likely to be even integral and embedded into the everyday lives of the average person (and potentially the average alien as we look to colonise other planets). For the meantime, at Blockpass we use the technology and capabilities we have at hand to provide the best identity verification and management we can.

As 2019 comes to a close, there are a number of reports that examine the state of blockchain adoption and the use of blockchain-based identity management. Three of those reports are: Gartner’s Market Guide for Identity Proofing and Corroboration; GovChain’s examination of blockchain adoption by country; and Global Blockchain Identity Management Market – Industry Analysis and Forecast (2019-2026) by Maximise Market Research. By examining each of these reports, it is possible to gain an insight on how blockchain and identity solutions are being received.

Starting with the GovChain report, which was partly sponsored by Blockpass, the adoption of blockchain in a number of countries around the world can be seen. The report ranks each country as either an adopter (actively seeking or using blockchain solutions), investigator (carried out preliminary work but of limited development and possibly only in a particular sector), and sceptic (those not investigating, or possibly actively curtailing, blockchain solutions).

Some countries are grouped together where appropriate (The EU being one such example and the UK being another) but differences in blockchain uptake are noted where relevant (France being noted as an ‘investigator’, and certain US States being noted for particular views. Areas in which blockchain technology is being used in the jurisdictions analysed include agriculture, land registry, voting, fintech and other areas.

In total, 24 different instances were examined, with the split between their approaches shown below:

These results show a significant slant towards a positive reception and active development of blockchain solutions from the areas analysed, and is encouraging for the future of blockchain adoption as it becomes more normalised. Many of those countries or jurisdictions listed as ‘Investigator’ were described as actively moving towards being considered an ‘adopter’, but had not yet fully implemented or developed the necessary criteria. Even though it was designated as ‘sceptic’ of blockchain adoption, China was noted to have invested billions into research and development of blockchain solutions; much of the hesitancy and uncertainty in this case is towards the use of cryptocurrencies, and the decentralised nature conflicting with the government’s desire for control and censorship of certain areas.

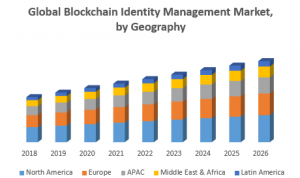

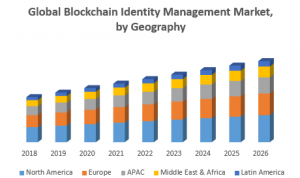

This growth of blockchain adoption is mirrored in the report from Maximise Market Research. Taking a close look at a forecast for global blockchain identity management markets, the report predicts a significant growth in the blockchain identity market. This was shown in the following graphic from the report:

The report discusses benefits of decentralised identity management, and the related issues that arise from lack of regulation and uncertainty around a new technology. Additionally, the report highlights the increasingly sought-after ability to provide security, self-sovereignty, simplified and immutable solutions, which blockchain-based identity solutions have the opportunity to bring. This push far outstrips the negative issues and is predicted to drive the rise of blockchain identity solutions predicted.

In its analysis, the Maximise Market Research report went into details on industries, providers and regions. Unsurprisingly, banking, finance and insurance was identified as being the main focus for blockchain identity management, with the benefits blockchain solutions have over traditional methods cited as being a driving factor. Application providers are similarly expected to do well, and the North American market is predicted to show the most growth.

The Gartner report discusses the necessity for blockchain-based solutions due to the weakness of traditional personally identifying information systems and the method by which identity is traditionally verified and managed. Security features such as ‘shared secret info’ like questions or memorable data are called out as allowing security breaches to happen on a massive scale.

These large data breaches have become so commonplace that it has seen criminal activity shift. Rather than being simple identity theft, criminals often now create false identities using elements of multiple real identities - leading to a criminal being able to build a credible credit history etc for a non-existent person - this is much tougher to detect than simple identity theft.

Criteria of identity verification requirements have also changed, with the report pointing out the new focus on remote interactions (non-face-to-face) becoming the norm, and the new requirements to identify people in this manner. This was described as having lead to a heavy focus on security despite the consumer’s preference of convenience over safety. Due to this, it was stated that making the user experience as frictionless and painless as possible is key for onboarding and retention of new customers.

In its recommendations, the report stated: “The lines between online fraud detection, identity proofing and user authentication use cases are increasingly blurring with regard to the techniques that can be applied to increase trust in an identity assertion and better identify malicious or anomalous activity”. A variety of signals and credentials and risk indicators are recommended to be used for identity verification; however, the report described how businesses can’t simply stack together multiple methods and expect to be successful. Rather, businesses need to have weighting and logic behind their integration of security measures and maintain a strong focus on fraud detection.

To those seeking identity verification, Gartner suggested seeking out solutions which combined manual and automated document checking, and which provided AML checks. The report also noted that storage of the relevant documentation was a factor to consider: where documentation is stored, if it is secure, if it needs to be stored, and who it needs to be stored with.

An interesting development highlighted by the Gartner report was the use of e-mail addresses and mobile phone numbers as digital identity identifiers due to their tendency to remain the same, even when a users’ other circumstances such as housing or conventional identity documentation changed. There was also a potential noted for social media to be used as ID verification, as often has up to date data from the user.

The report stated: “Behavior analysis can allow the observation and analysis of users’ activities within a digital property or IVR. This can include analysis of: the way users type, the placement and timing of their mouse movements and clicks, the way they scroll, their swipe pattern on a mobile device, the way they interact with an IVR, the time they spend viewing a page before taking the next action”. There are many more ways to identify people now than there were before, and new technology needs to be used to leverage these highly-unique identifiers to create strong and simple verification.

Across all three reports the conclusion is reinforced: blockchain-based identity verification and management is changing and growing. In the coming years, the already a sought-after capability identity verification and management tools that are being provided by Blockpass and others will become vital, and will increasingly become the norm. It is imperative that we continue our focus on ease-of-use and provide a positive user experience whilst maintaining the highest security standards possible. As global businesses and digital economies grow, it seems likely that digital (and blockchain-based) identity verification and management will become an integral part of our lives. Just as identity verification would have been an alien concept just a couple of hundred years ago, perhaps one day we will see a future where an alien like LeeLoo shares an identity that is a (verified and legitimate) Blockpass, rather than Multipass.

Starting with the GovChain report, which was partly sponsored by Blockpass, the adoption of blockchain in a number of countries around the world can be seen. The report ranks each country as either an adopter (actively seeking or using blockchain solutions), investigator (carried out preliminary work but of limited development and possibly only in a particular sector), and sceptic (those not investigating, or possibly actively curtailing, blockchain solutions).

Some countries are grouped together where appropriate (The EU being one such example and the UK being another) but differences in blockchain uptake are noted where relevant (France being noted as an ‘investigator’, and certain US States being noted for particular views. Areas in which blockchain technology is being used in the jurisdictions analysed include agriculture, land registry, voting, fintech and other areas.

In total, 24 different instances were examined, with the split between their approaches shown below:

| ‘Adopter’ | ‘Investigator’ | ‘Sceptic’ |

| Australia | France | Brazil |

| Bahrain | Ghana | China |

| Estonia | Haiti & Dominican Republic | |

| EU | Intergovernmental Approaches - The Organisation for Economic Co-Operation and Development (OECD) | |

| Gibraltar | ||

| Indonesia | ||

| Nigeria | Isle of Man | |

| Singapore | Kenya | |

| South Africa | Thailand | |

| Sweden | USA (Illinois, Colorado, Ohio, Montana, Delaware) | |

| UAE | ||

| UK | ||

| USA (Federa) | ||

| USA (Wyoming) |

These results show a significant slant towards a positive reception and active development of blockchain solutions from the areas analysed, and is encouraging for the future of blockchain adoption as it becomes more normalised. Many of those countries or jurisdictions listed as ‘Investigator’ were described as actively moving towards being considered an ‘adopter’, but had not yet fully implemented or developed the necessary criteria. Even though it was designated as ‘sceptic’ of blockchain adoption, China was noted to have invested billions into research and development of blockchain solutions; much of the hesitancy and uncertainty in this case is towards the use of cryptocurrencies, and the decentralised nature conflicting with the government’s desire for control and censorship of certain areas.

This growth of blockchain adoption is mirrored in the report from Maximise Market Research. Taking a close look at a forecast for global blockchain identity management markets, the report predicts a significant growth in the blockchain identity market. This was shown in the following graphic from the report:

The report discusses benefits of decentralised identity management, and the related issues that arise from lack of regulation and uncertainty around a new technology. Additionally, the report highlights the increasingly sought-after ability to provide security, self-sovereignty, simplified and immutable solutions, which blockchain-based identity solutions have the opportunity to bring. This push far outstrips the negative issues and is predicted to drive the rise of blockchain identity solutions predicted.

In its analysis, the Maximise Market Research report went into details on industries, providers and regions. Unsurprisingly, banking, finance and insurance was identified as being the main focus for blockchain identity management, with the benefits blockchain solutions have over traditional methods cited as being a driving factor. Application providers are similarly expected to do well, and the North American market is predicted to show the most growth.

The Gartner report discusses the necessity for blockchain-based solutions due to the weakness of traditional personally identifying information systems and the method by which identity is traditionally verified and managed. Security features such as ‘shared secret info’ like questions or memorable data are called out as allowing security breaches to happen on a massive scale.

These large data breaches have become so commonplace that it has seen criminal activity shift. Rather than being simple identity theft, criminals often now create false identities using elements of multiple real identities - leading to a criminal being able to build a credible credit history etc for a non-existent person - this is much tougher to detect than simple identity theft.

Criteria of identity verification requirements have also changed, with the report pointing out the new focus on remote interactions (non-face-to-face) becoming the norm, and the new requirements to identify people in this manner. This was described as having lead to a heavy focus on security despite the consumer’s preference of convenience over safety. Due to this, it was stated that making the user experience as frictionless and painless as possible is key for onboarding and retention of new customers.

In its recommendations, the report stated: “The lines between online fraud detection, identity proofing and user authentication use cases are increasingly blurring with regard to the techniques that can be applied to increase trust in an identity assertion and better identify malicious or anomalous activity”. A variety of signals and credentials and risk indicators are recommended to be used for identity verification; however, the report described how businesses can’t simply stack together multiple methods and expect to be successful. Rather, businesses need to have weighting and logic behind their integration of security measures and maintain a strong focus on fraud detection.

To those seeking identity verification, Gartner suggested seeking out solutions which combined manual and automated document checking, and which provided AML checks. The report also noted that storage of the relevant documentation was a factor to consider: where documentation is stored, if it is secure, if it needs to be stored, and who it needs to be stored with.

An interesting development highlighted by the Gartner report was the use of e-mail addresses and mobile phone numbers as digital identity identifiers due to their tendency to remain the same, even when a users’ other circumstances such as housing or conventional identity documentation changed. There was also a potential noted for social media to be used as ID verification, as often has up to date data from the user.

The report stated: “Behavior analysis can allow the observation and analysis of users’ activities within a digital property or IVR. This can include analysis of: the way users type, the placement and timing of their mouse movements and clicks, the way they scroll, their swipe pattern on a mobile device, the way they interact with an IVR, the time they spend viewing a page before taking the next action”. There are many more ways to identify people now than there were before, and new technology needs to be used to leverage these highly-unique identifiers to create strong and simple verification.

Across all three reports the conclusion is reinforced: blockchain-based identity verification and management is changing and growing. In the coming years, the already a sought-after capability identity verification and management tools that are being provided by Blockpass and others will become vital, and will increasingly become the norm. It is imperative that we continue our focus on ease-of-use and provide a positive user experience whilst maintaining the highest security standards possible. As global businesses and digital economies grow, it seems likely that digital (and blockchain-based) identity verification and management will become an integral part of our lives. Just as identity verification would have been an alien concept just a couple of hundred years ago, perhaps one day we will see a future where an alien like LeeLoo shares an identity that is a (verified and legitimate) Blockpass, rather than Multipass.