Industry solutions

‘Digital identity’ is a term that encapsulates the variety of information about a particular entity that exists in an online form.

Most commonly applied to humans, it can also be used to refer to businesses and organisations, or, increasingly, applications and devices.

In the digital world, where a physical presence and identity documents are not able to exist, digital identities are used to represent physical entities, as well as to provide an identity for entities that only exist in a digital form.

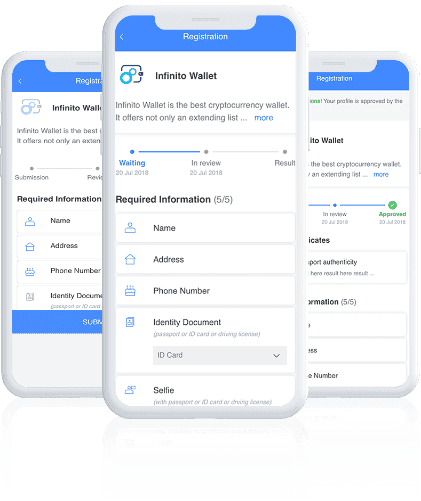

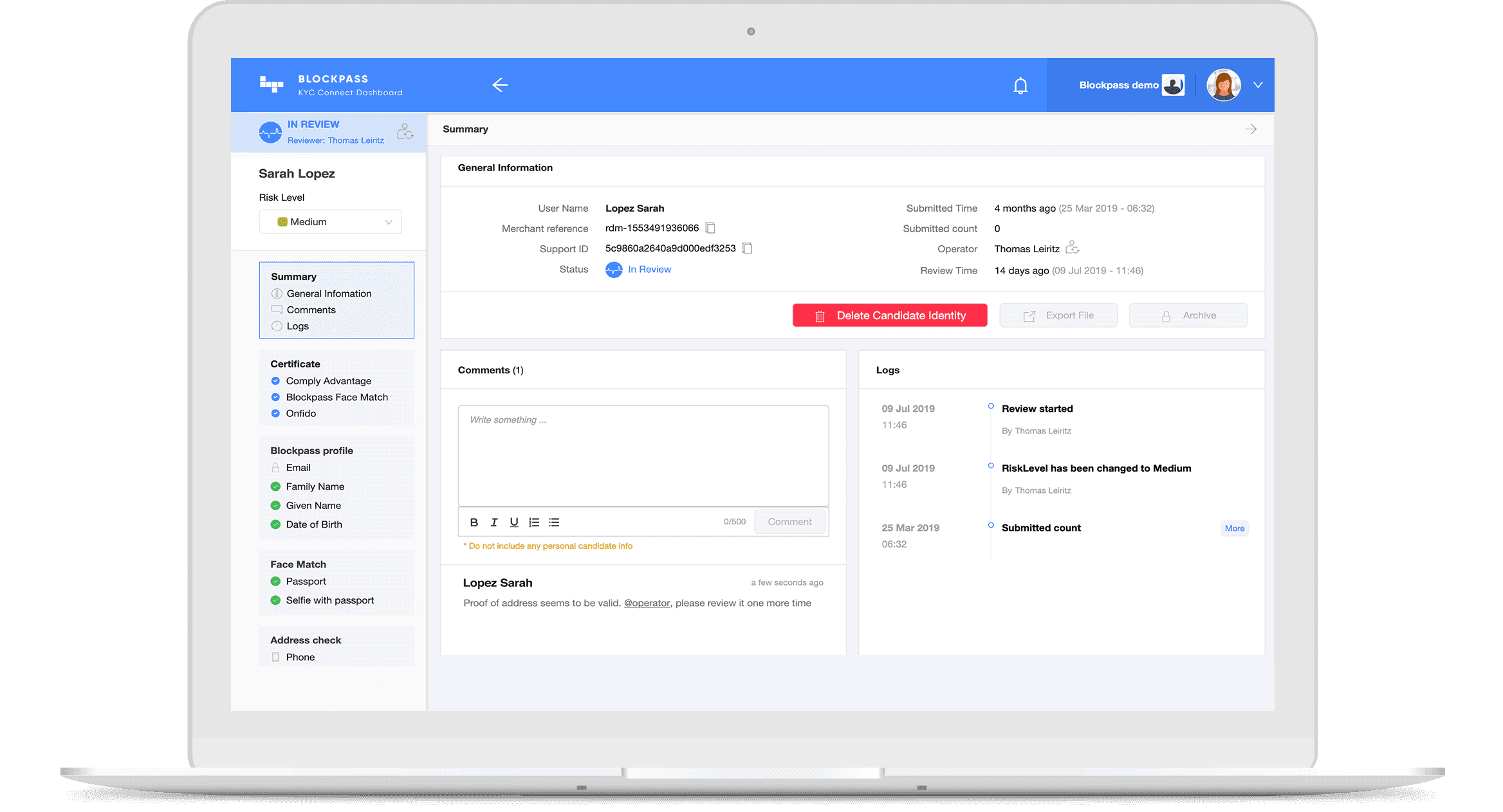

The need for a verified digital identity can be seen in Know Your Customer (KYC) regulations – where financial services are required to verify that the people they are conducting business with are not criminals. Without a verified digital identity, there would be no way of ascertaining whether a digital entity was who or what it claimed to be, frustrating those who need to comply with regulations or who want to interact with specific entities.

“In providing verified digital identities, a potential future becomes possible where the online world becomes safe and effective.”

The benefits of using digital solutions and online alternatives to traditional methods are huge: efficiency, speed, globalisation, freedom, choice, cost effectiveness and more are all potential outcomes, but ensuring the safety and security of interactions and transactions needs to be established first, which is only possible when everything has a verified digital identity. The security of these identities are paramount.

When companies store users’ personal data for KYC or access permissions, it effectively creates a honeypot that is extremely attractive to criminals.\ With the Internet of Things on the horizon – where everyone and everything will be connected digitally – there is an incredible risk in having personal information online and digital identities without adequate security.

Despite the need for companies to conduct KYC and other forms of regulation, having them store and control personal data has repeatedly proved to be an issue.