Media

Guide to Global AML Regulations [2020]

November 05, 2020

There have been increasingly expansive Anti Money Laundering (AML) laws and regulations in recent years which have increased the potential risks of fines and penalties if businesses fail to comply with them. It is vital for business owners to strive for a balance between identifying AML risks and allocating resources on AML compliance efforts as the incurred costs can be considerable.

You may be wondering what laws and regulations will be impacting your business; well, regulations can be different among various jurisdictions and this can potentially be a difficult area to navigate for businesses with branches all over the globe. You might also wonder what some best practices for AML compliance are. We have summarized some key regulations for major jurisdictions and also included links to important information.

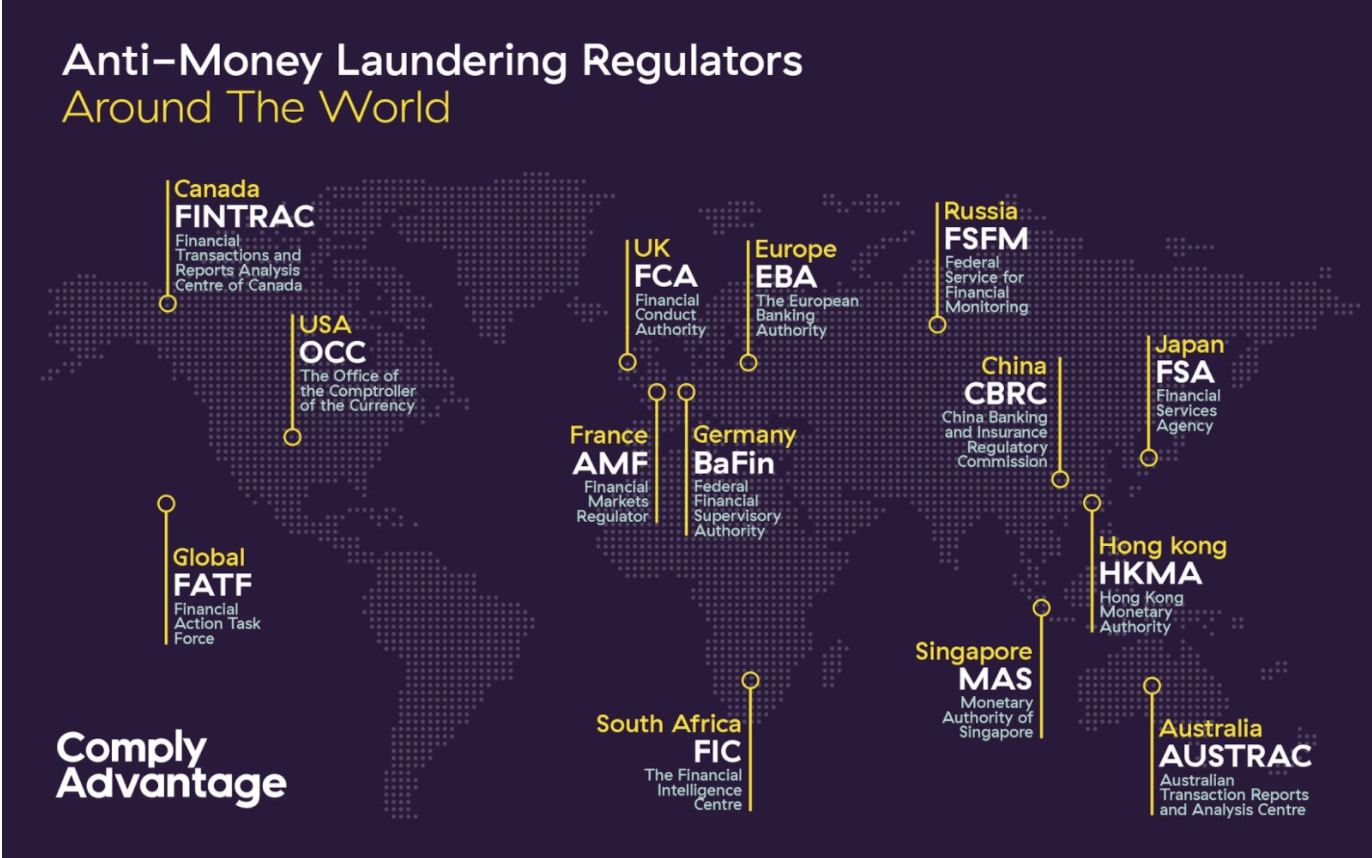

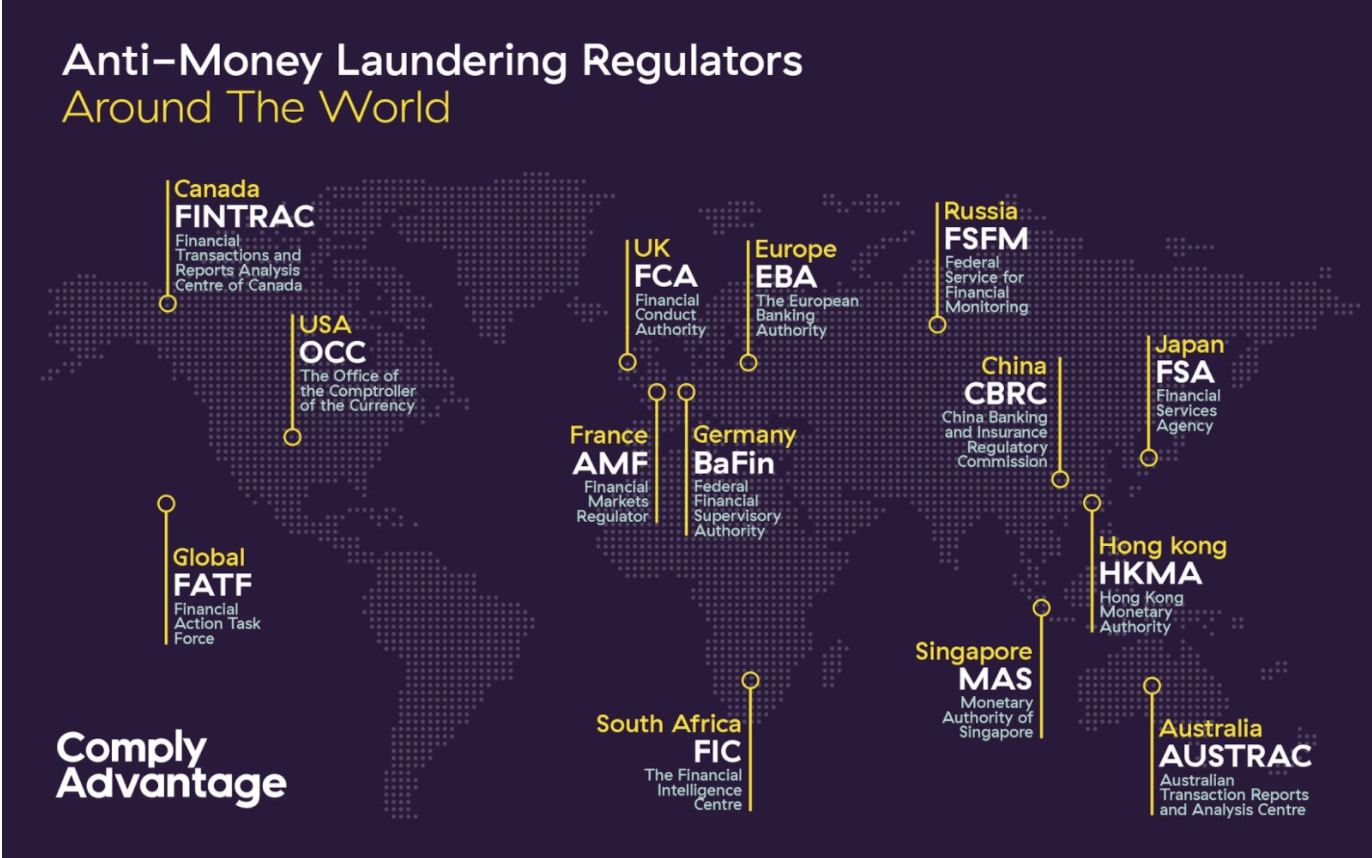

Our partner, Comply Advantage, has published a map that summarizes the global AML landscape of major jurisdictions.

We are going to summarize recommendations and useful information of some major jurisdictions like the US, Canada, Europe, Hong Kong and Australia.

Global

A global organization, FATF is formed by national regulators to respond to the threats posed by money laundering by the G7 group of countries. It is an inter-governmental body whose objectives include setting standards to combat money laundering, the financing of terrorism and the financing of proliferation of weapons of mass destruction (AML/CFT), and supporting the implementation of these standards.

The core documents of the FATF (referred to as the "FATF standards") include: 40 recommendations, including interpretative notes, of 2019; Methodology for assessing compliance of 2019; and Various best practice guidelines.

Our team published a summary when the FATF updated their recommendations in 2019. You can now read the article here.

North America

US

The USA Patriot Act of 2001 amends the Bank Secrecy Act (BSA) by requiring all financial institutions to establish Anti-Money Laundering (AML) programs. This is to strengthen the USA’s measures to prevent, detect, and prosecute money laundering and the financing of terrorism.

Other than AML program establishments, financial institutions are also required to have a comprehensive reporting system to cover Suspicious Activities Reports (SARs), Currency Transactions Reports (CTRs) etc. to ensure compliance is in place.

In addition, a strict customer identification program has to be in place that fulfills certain requirements in order to combat money laundering.

You can read more information here.

https://www.fincen.gov/history-anti-money-laundering-laws

https://www.occ.treas.gov/topics/supervision-and-examination/bsa/bsa-related-regulations/index-bsa-and-related-regulations.html

Canada

The Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) plays an important role in the Candadian AML landscape. FINTRAC provides guidance to AML programs to ensure financial institutions comply with the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA). It provides a compliance program framework for financial institutions to follow including transaction reportings, know your customer requirements, record keeping protocols etc.

The FINTRAC is not only responsible for providing a guideline, but it also examines entities as to whether they are compliant with the PCMLTFA or not.

Useful Links

https://www.fintrac-canafe.gc.ca/guidance-directives/1-eng

Europe

Europe follows a set of compliance frameworks which include a couple of regulations as below:

Useful Links

https://sfl.global/en/news_post/a-guide-to-aml-regulations-and-kyc-requirements-in-europe/

https://www.investopedia.com/terms/m/mifid-ii.asp

APAC

Hong Kong

The Hong Kong Monetary Authority (HKMA) is the regulatory body and a central banking institution in Hong Kong. It is responsible for the stability of Hong Kong’s banking system and monetary policy, maintaining currency stability within the framework of the Linked Exchange Rate System; promoting the stability and integrity of the financial system, including the banking system; helping to maintain Hong Kong's status as an international financial centre, including the maintenance and development of Hong Kong's financial infrastructure and managing the Exchange Fund.

Under the authority of the Anti-Money Laundering and Counter-Terrorist Financing Ordinance, it ensures that financial institutions in Hong Kong are meeting a variety of legal requirements, including an effective AML/CTF program.

Useful Links

https://www.hkma.gov.hk/eng/about-us/the-hkma/

Australia

AUSTRAC is the Australian Government agency responsible for detecting, deterring and disrupting criminal abuse of the financial system to protect the community from serious and organised crime. It ensures financial instituions follow the AML protocol under the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (AML/CTF Act) and the Financial Transaction Reports Act 1988 (FTR Act). Similar to other regulatory bodies, it requires financial institutions with certain reporting requirements to report suspicious transactions, transactions over certain threshold and internal funds transfers etc. It strives to mitigate emerging regulatory risks, and form a rigid legislative framework for AML/CTF.

Many regions are taking AML as a serious issue by establishing a government regulatory body to combat money laundering and have a similar or standardized approach to detect and deter money laundering. As a multinational company, it is not easy to ensure compliance excellence in all jurisdictions.

A third-party solution like Blockpass provides a solution which is ideal for the customer due diligence. With fast and secure KYC and AML compliance, and the ability to flexibly, quickly and easily manage identities, it ensures regulatory compliance without the hassle traditionally associated with KYC. The Blockpass model would also be ideal for industries like online businesses, financial institutions, the cryptocurrency industry and others which can see a large number of users who need identity as those involved aim for the highest standards in regulatory compliance. Blockpass’ reusable KYC can help combat money laundering without causing undue financial burdens to companies.

Our partner, Comply Advantage, has published a map that summarizes the global AML landscape of major jurisdictions.

We are going to summarize recommendations and useful information of some major jurisdictions like the US, Canada, Europe, Hong Kong and Australia.

Global

A global organization, FATF is formed by national regulators to respond to the threats posed by money laundering by the G7 group of countries. It is an inter-governmental body whose objectives include setting standards to combat money laundering, the financing of terrorism and the financing of proliferation of weapons of mass destruction (AML/CFT), and supporting the implementation of these standards.

The core documents of the FATF (referred to as the "FATF standards") include: 40 recommendations, including interpretative notes, of 2019; Methodology for assessing compliance of 2019; and Various best practice guidelines.

Our team published a summary when the FATF updated their recommendations in 2019. You can now read the article here.

North America

US

The USA Patriot Act of 2001 amends the Bank Secrecy Act (BSA) by requiring all financial institutions to establish Anti-Money Laundering (AML) programs. This is to strengthen the USA’s measures to prevent, detect, and prosecute money laundering and the financing of terrorism.

Other than AML program establishments, financial institutions are also required to have a comprehensive reporting system to cover Suspicious Activities Reports (SARs), Currency Transactions Reports (CTRs) etc. to ensure compliance is in place.

In addition, a strict customer identification program has to be in place that fulfills certain requirements in order to combat money laundering.

You can read more information here.

https://www.fincen.gov/history-anti-money-laundering-laws

https://www.occ.treas.gov/topics/supervision-and-examination/bsa/bsa-related-regulations/index-bsa-and-related-regulations.html

Canada

The Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) plays an important role in the Candadian AML landscape. FINTRAC provides guidance to AML programs to ensure financial institutions comply with the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA). It provides a compliance program framework for financial institutions to follow including transaction reportings, know your customer requirements, record keeping protocols etc.

The FINTRAC is not only responsible for providing a guideline, but it also examines entities as to whether they are compliant with the PCMLTFA or not.

Useful Links

https://www.fintrac-canafe.gc.ca/guidance-directives/1-eng

Europe

Europe follows a set of compliance frameworks which include a couple of regulations as below:

- The Anti Money Laundering Directive (AMLD) is established to fight against money laundering typologies, terrorist financing across EU regions. The directive is regularly updated in order to cope with the latest compliance landscape. The Sixth Anti-Money Laundering Directive (6AMLD) is being launched to replace 5AMLD and 4AMLD. AMLD also aims at promoting collaboration between countries.

- The Payments Services Directive (PSD2) is introduced to regulate payment services and payment service providers throughout Europe.

- Markets in Financial Instruments Directive (MiFID II) was launched in 2008 after the financial crisis in 2007 to provide more transparency and protections to investors. It also regulates off-exchange and OTC trading, essentially pushing it onto official exchanges.

- The General Data Protection Regulation (GDPR), the EU’s response to the general public’s request to regain control over personal data.

Useful Links

https://sfl.global/en/news_post/a-guide-to-aml-regulations-and-kyc-requirements-in-europe/

https://www.investopedia.com/terms/m/mifid-ii.asp

APAC

Hong Kong

The Hong Kong Monetary Authority (HKMA) is the regulatory body and a central banking institution in Hong Kong. It is responsible for the stability of Hong Kong’s banking system and monetary policy, maintaining currency stability within the framework of the Linked Exchange Rate System; promoting the stability and integrity of the financial system, including the banking system; helping to maintain Hong Kong's status as an international financial centre, including the maintenance and development of Hong Kong's financial infrastructure and managing the Exchange Fund.

Under the authority of the Anti-Money Laundering and Counter-Terrorist Financing Ordinance, it ensures that financial institutions in Hong Kong are meeting a variety of legal requirements, including an effective AML/CTF program.

Useful Links

https://www.hkma.gov.hk/eng/about-us/the-hkma/

Australia

AUSTRAC is the Australian Government agency responsible for detecting, deterring and disrupting criminal abuse of the financial system to protect the community from serious and organised crime. It ensures financial instituions follow the AML protocol under the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (AML/CTF Act) and the Financial Transaction Reports Act 1988 (FTR Act). Similar to other regulatory bodies, it requires financial institutions with certain reporting requirements to report suspicious transactions, transactions over certain threshold and internal funds transfers etc. It strives to mitigate emerging regulatory risks, and form a rigid legislative framework for AML/CTF.

Many regions are taking AML as a serious issue by establishing a government regulatory body to combat money laundering and have a similar or standardized approach to detect and deter money laundering. As a multinational company, it is not easy to ensure compliance excellence in all jurisdictions.

A third-party solution like Blockpass provides a solution which is ideal for the customer due diligence. With fast and secure KYC and AML compliance, and the ability to flexibly, quickly and easily manage identities, it ensures regulatory compliance without the hassle traditionally associated with KYC. The Blockpass model would also be ideal for industries like online businesses, financial institutions, the cryptocurrency industry and others which can see a large number of users who need identity as those involved aim for the highest standards in regulatory compliance. Blockpass’ reusable KYC can help combat money laundering without causing undue financial burdens to companies.